“NFT Staking: A Comprehensive Guide to Earning Passive Income with Your Digital Assets

Artikel Terkait NFT Staking: A Comprehensive Guide to Earning Passive Income with Your Digital Assets

- NFT Airdrops: A Comprehensive Guide To Free Digital Assets

- Generative Art: Where Code Meets Creativity

- NFT Drops: A Comprehensive Guide

- NFT Minting: A Comprehensive Guide To Creating Digital Assets On The Blockchain

- Okay, Here’s A Comprehensive Article About NFTs (Non-Fungible Tokens), Aiming For Approximately 1600 Words.

Table of Content

Video tentang NFT Staking: A Comprehensive Guide to Earning Passive Income with Your Digital Assets

NFT Staking: A Comprehensive Guide to Earning Passive Income with Your Digital Assets

Non-fungible tokens (NFTs) have taken the digital world by storm, revolutionizing the way we perceive ownership and value in the digital realm. While NFTs initially gained traction as digital collectibles and art pieces, their utility has expanded significantly, giving rise to innovative concepts like NFT staking. NFT staking presents an exciting opportunity for NFT holders to earn passive income by locking up their digital assets on a platform or protocol. This comprehensive guide delves into the intricacies of NFT staking, exploring its mechanisms, benefits, risks, and future prospects.

Understanding NFT Staking

NFT staking is the process of locking up your NFTs on a platform or protocol to earn rewards, typically in the form of tokens, additional NFTs, or other benefits. By staking your NFTs, you essentially contribute to the security and functionality of the platform, and in return, you receive compensation for your participation.

The concept of NFT staking is similar to staking cryptocurrencies, where you lock up your digital assets to support the network and earn rewards. However, NFT staking introduces a unique dimension by leveraging the inherent value and scarcity of NFTs.

How NFT Staking Works

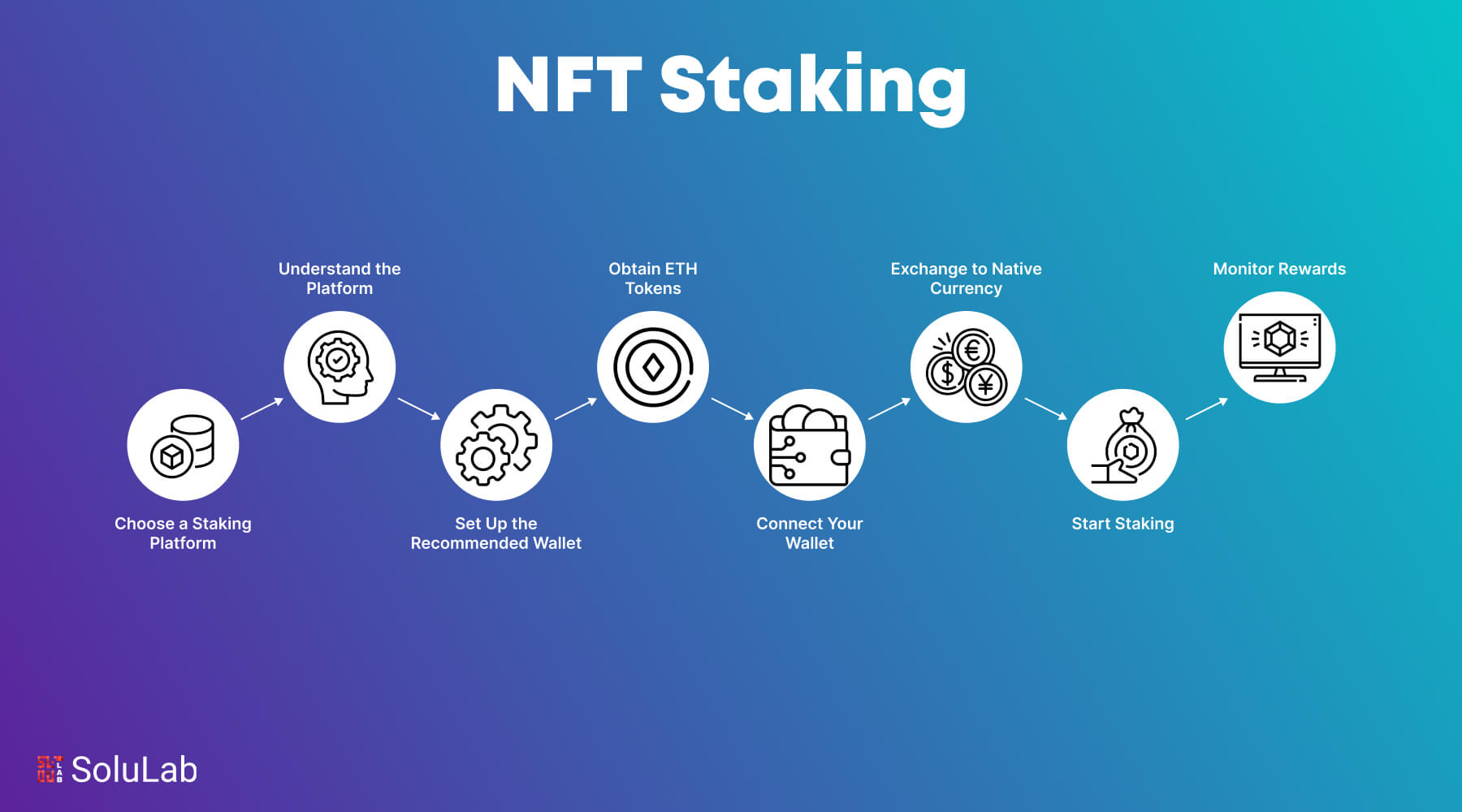

The mechanics of NFT staking can vary depending on the platform or protocol involved. However, the general process typically involves the following steps:

- Choose a Platform: Select a reputable platform or protocol that supports NFT staking for the specific NFT collection you own.

- Connect Your Wallet: Connect your digital wallet to the platform, ensuring that it is compatible with the supported blockchain network.

- Stake Your NFTs: Select the NFTs you wish to stake and confirm the transaction. Your NFTs will be locked up in the platform’s smart contract.

- Earn Rewards: Once your NFTs are staked, you will start earning rewards based on the platform’s staking mechanism. Rewards can be distributed in various forms, such as tokens, additional NFTs, or other benefits.

- Unstake Your NFTs: When you wish to retrieve your NFTs, you can unstake them from the platform. Depending on the platform’s rules, there may be a waiting period before you can withdraw your NFTs.

Benefits of NFT Staking

NFT staking offers a range of benefits for both NFT holders and the platforms that support it:

- Passive Income: NFT staking allows you to earn passive income on your NFT holdings without having to actively trade or sell them. This can be an attractive option for long-term NFT holders who want to generate additional value from their assets.

- Increased Utility: NFT staking enhances the utility of NFTs by providing a mechanism for them to generate income. This can increase the demand and value of NFTs, as holders can now benefit from their assets in more ways than just ownership.

- Community Engagement: NFT staking can foster a sense of community engagement and participation within NFT projects. By staking their NFTs, holders become active contributors to the platform and can earn rewards for their involvement.

- Platform Growth: NFT staking can incentivize users to hold and stake their NFTs on a platform, which can help to increase the platform’s user base and overall value.

- Reduced Volatility: By locking up NFTs, staking can reduce the circulating supply of NFTs, which can potentially stabilize prices and reduce volatility.

Risks of NFT Staking

While NFT staking offers several benefits, it’s essential to be aware of the potential risks involved:

- Smart Contract Risk: NFT staking platforms rely on smart contracts to manage the staking process and distribute rewards. If the smart contract has vulnerabilities or bugs, it could lead to loss of funds or NFTs.

- Platform Risk: The platform you choose to stake your NFTs on could be subject to hacks, scams, or rug pulls. It’s crucial to research the platform thoroughly and ensure that it has a strong reputation and security measures in place.

- Liquidity Risk: When you stake your NFTs, they become locked up and unavailable for trading or selling. If you need to access your NFTs urgently, you may not be able to unstake them immediately, depending on the platform’s rules.

- Valuation Risk: The value of the rewards you earn from NFT staking may fluctuate depending on market conditions. If the value of the rewards decreases, your overall returns may be lower than expected.

- Regulatory Risk: The regulatory landscape surrounding NFTs and NFT staking is still evolving. There is a risk that future regulations could impact the legality or viability of NFT staking platforms.

Examples of NFT Staking Platforms

Several platforms offer NFT staking services, each with its own unique features and rewards:

- Splinterlands: A popular blockchain-based trading card game that allows players to stake their in-game NFTs to earn rewards in the form of Dark Energy Crystals (DEC).

- MOBOX: A GameFi platform that allows users to stake their MOMO NFTs to earn rewards in the form of MBOX tokens.

- NFTX: A platform that allows users to create and trade NFT-backed tokens. Users can stake their NFTs in NFTX vaults to earn fees from trading activity.

- ZooKeeper: A decentralized autonomous organization (DAO) that allows users to stake their NFTs to earn rewards in the form of ZOO tokens.

- Bored Ape Yacht Club: Although not a staking platform in itself, the Bored Ape Yacht Club has implemented staking mechanisms through partnerships with other platforms, allowing holders to earn ApeCoin (APE) by staking their Bored Ape NFTs.

Factors to Consider Before Staking NFTs

Before staking your NFTs, it’s essential to consider the following factors:

- Platform Reputation: Research the platform thoroughly and ensure that it has a strong reputation, security measures, and a track record of reliability.

- Staking Terms: Carefully review the staking terms and conditions, including the lock-up period, reward structure, and any associated fees.

- Smart Contract Audits: Check if the platform’s smart contracts have been audited by reputable security firms.

- Community Feedback: Read reviews and feedback from other users to get an idea of their experience with the platform.

- Risk Tolerance: Assess your risk tolerance and only stake NFTs that you are comfortable locking up for the specified period.

The Future of NFT Staking

NFT staking is still a relatively new concept, but it has the potential to revolutionize the way we interact with and value NFTs. As the NFT market continues to grow and evolve, we can expect to see more innovative staking mechanisms and platforms emerge.

Some potential future developments in NFT staking include:

- More Diverse Rewards: Platforms may offer a wider range of rewards for staking NFTs, such as access to exclusive content, discounts on products or services, or governance rights within the platform.

- Dynamic Staking: Staking mechanisms may become more dynamic, allowing users to adjust their staking positions based on market conditions or personal preferences.

- Cross-Chain Staking: Platforms may enable users to stake NFTs across different blockchain networks, increasing the accessibility and utility of NFT staking.

- Integration with DeFi: NFT staking may become more integrated with decentralized finance (DeFi) protocols, allowing users to leverage their staked NFTs for lending, borrowing, or other financial activities.

- Increased Institutional Adoption: As the NFT market matures, we may see more institutional investors participate in NFT staking, bringing greater legitimacy and stability to the space.

Conclusion

NFT staking presents an exciting opportunity for NFT holders to earn passive income and enhance the utility of their digital assets. By carefully considering the risks and benefits involved, and by choosing reputable platforms with robust security measures, you can potentially generate significant value from your NFT holdings through staking. As the NFT market continues to evolve, NFT staking is likely to play an increasingly important role in shaping the future of digital ownership and value creation.